1.简介

2.估计波动率

已实现波动率; GARCH 族模型; (期权)隐含波动率。

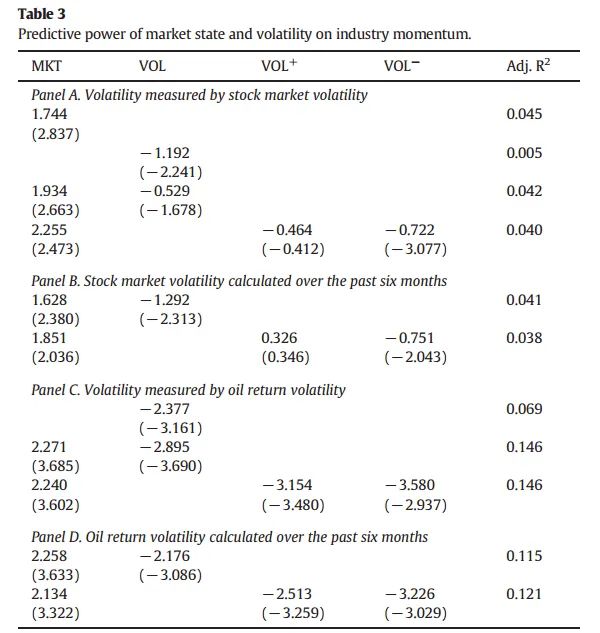

3.对股市/行业的影响

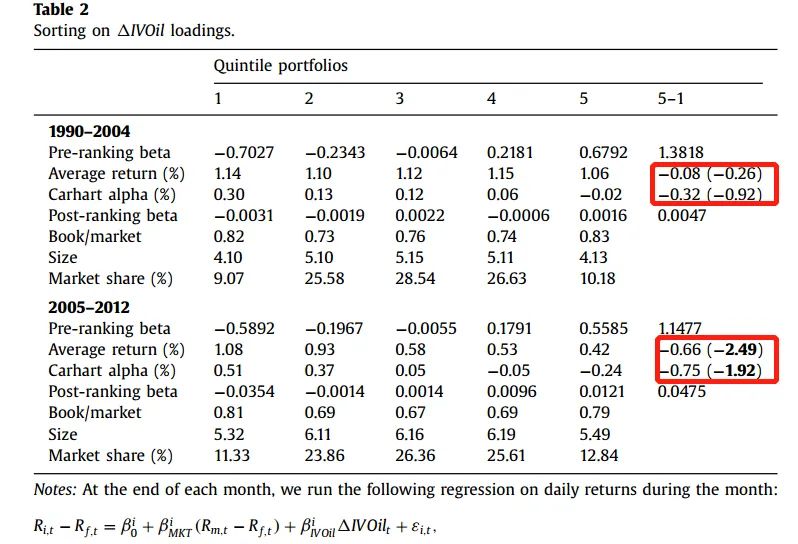

4.对个股的影响

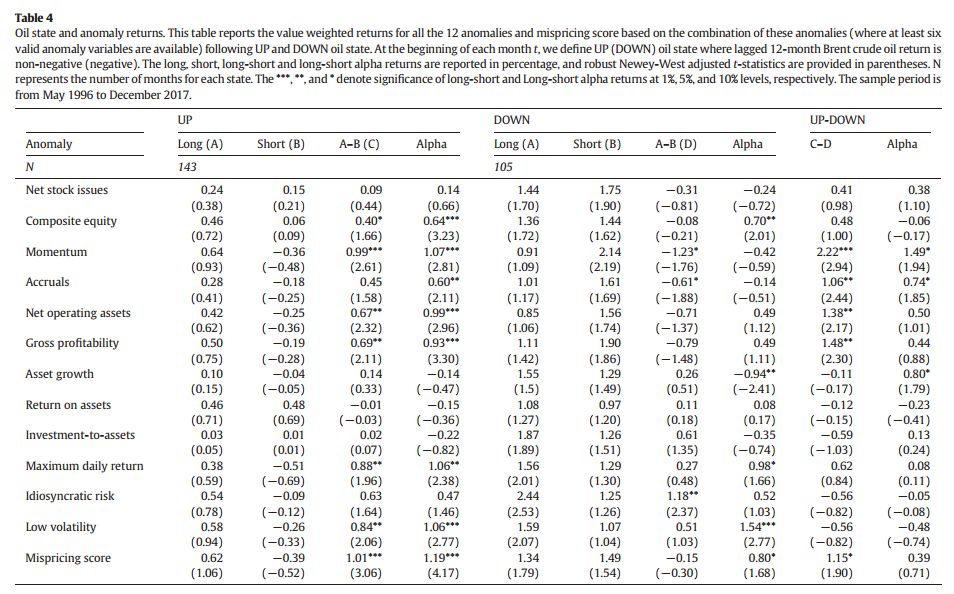

5.对异象的影响

6.结语

历史推荐

文章索引:因子投资小册子

研究方法论:【027】追寻因子的足迹:分类、构造与检验

因子选择:【045】Which Characteristics?

机器学习:【041】机器学习驱动的基本面量化投资

搞事情小组:搞事情深度研究| 异质波动率之谜

故事分享:真实故事| 艰难的 2019,我是如何赚到 1000 万和 200% 的

实证研究:【043】基本面动量在 A 股

另类因子:【034】外部融资越多,股票收益就越低吗?

投资因子:【031】投资效应:Factor War 前传

低风险因子:【018】低风险异象靠谱吗?解释与批判

动量因子:【010】横截面动量那些事

Ang, Andrew, Robert J. Hodrick, Yuhang Xing, and Xiaoyan Zhang. "The Cross‐section of Volatility and Expected Returns." Journal of Finance61.1 (2006): 259-299. Bali, Turan G., Robert F. Engle, and Scott Murray. "Empirical Asset Pricing: The Cross-Section of Stock Returns." John Wiley & Sons, 2016. Cheema, Muhammad A., and Frank Scrimgeour. "Oil Prices and Stock Market Anomalies." Energy Economics83 (2019): 578-587. Chen, Chun-Da, Chiao-Ming Cheng, and Rıza Demirer. "Oil and Stock Market Momentum." Energy Economics68 (2017): 151-159. Christoffersen, Peter, and Xuhui Nick Pan. "Oil Volatility Risk and Expected Stock Returns." Journal of Banking & Finance95 (2018): 5-26. Diaz, Elena Maria, Juan Carlos Molero, and Fernando Perez de Gracia. "Oil Price Volatility and Stock Returns in the G7 Economies." Energy Economics54 (2016): 417-430. Jo, Soojin. "The Effects of Oil Price Uncertainty on Global Real Economic Activity." Journal of Money, Credit and Banking46.6 (2014): 1113-1135. Park, Jungwook, and Ronald A. Ratti. "Oil Price Shocks and Stock Markets in the US and 13 European Countries." Energy Economics30.5 (2008): 2587-2608. Wang, Yudong, Yu Wei, Chongfeng Wu, and Libo Yin. "Oil and the Short-term Predictability of Stock Return Volatility." Journal of Empirical Finance47 (2018): 90-104. Xiao, Jihong, Min Zhou, Fengming Wen, and Fenghua Wen. "Asymmetric Impacts of Oil Price Uncertainty on Chinese Stock Returns Under Different Market Conditions: Evidence from Oil Volatility Index." Energy Economics74 (2018): 777-786. Xiao, Jihong, Chunyan Hu, Guangda Ouyang, and Fenghua Wen. "Impacts of Oil Implied Volatility Shocks on Stock Implied Volatility in China: Empirical Evidence from a Quantile Regression Approach." Energy Economics80 (2019): 297-309.